Unmanned Aerial Vehicles(UAVs), more commonly known as drones, have made a significant impact across various industries. Among their many applications, drone delivery services have emerged as one of the most transformative technologies. Our Drone Delivery Patent Landscape Report explores patenting trends, major players, key forces driving growth, as well as the technological challenges shaping this evolving field. We also feature some of the startups in the field and a closer look at their patent portfolios.

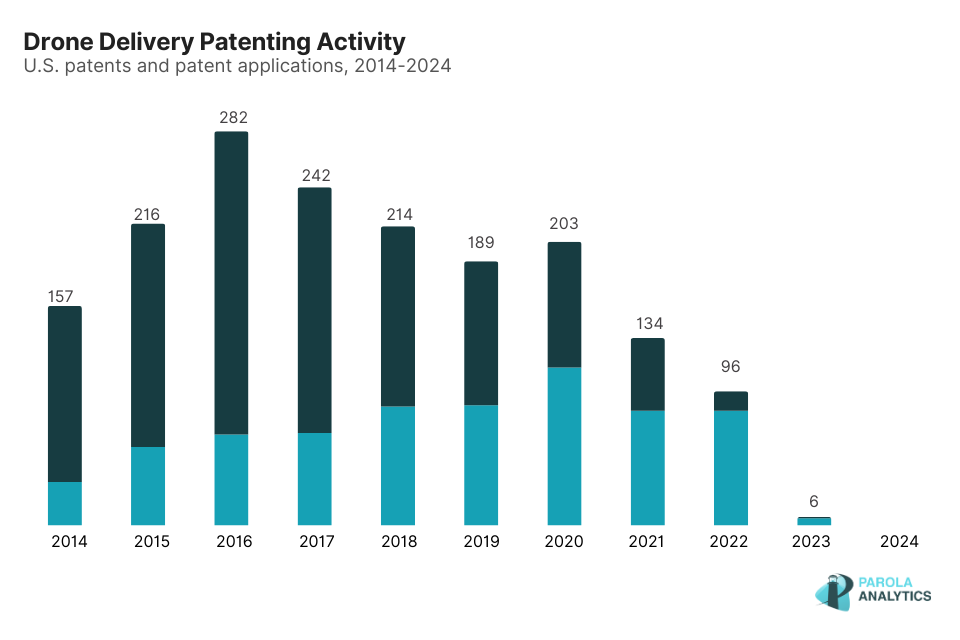

Drone delivery patent filings peaked in 2016

An analysis of U.S. patents and patent applications between January 1, 2014, and August 1, 2024, highlights significant activity in drone delivery technologies. The dataset includes 1,739 patents and applications, with approximately 61.41% of these patents granted.

A noticeable spike in patent filings occurred in 2016. While various factors have contributed to the fluctuations in patent filings for drone technology, the FAA Modernization and Reform Act of 2012,which facilitated the integration of UAVs into the national airspace, played a pivotal role in shaping the innovation landscape. The regulatory changes it introduced may have significantly influenced the pace and direction of technological advancements in the industry

Drone technology was already a burgeoning field pre-2012, but by establishing frameworks to integrate drones into commercial airspace, it has spurred significant innovation from the private sector. Logistics giants such as Amazon, Walmart and UPS to startups such as Zipline and Matternet increased their development of drone technologies geared towards package deliveries.

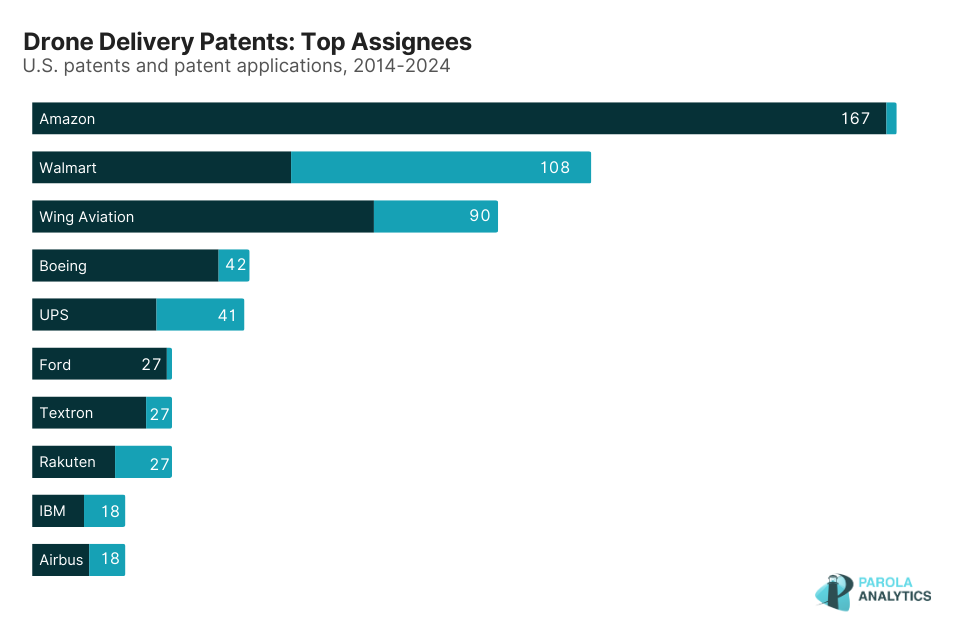

Amazon, Walmart emerge as the drone delivery patent leaders

Amazon holds the largest number of drone delivery-related patents over the past decade but has been slower to roll out its services compared to competitors like Walmart, Alphabet subsidiary, Wing Aviation, and startups such as DroneUp, Flytrex, and Zipline.

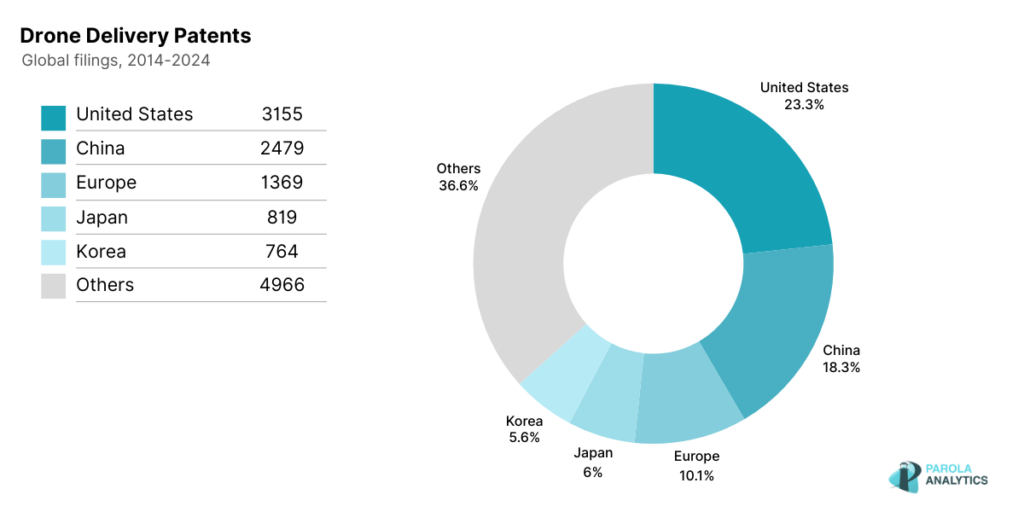

63% of global drone delivery patent filings are in the US, China, Europe, Japan and Korea

The U.S. remains a dominant force in the patent landscape, alongside China, Europe, Japan, and Korea, with these regions collectively accounting for over 63% of worldwide patent activity.

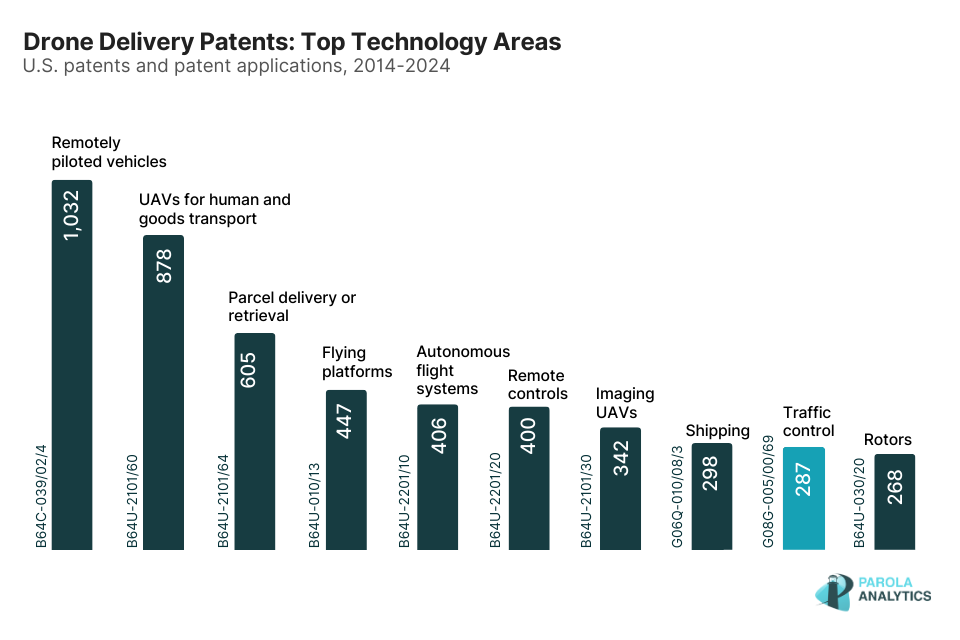

Regulatory barriers having significant impact on the technological landscape

Despite the promising market outlook, several challenges continue to hinder widespread adoption of drone delivery services. Regulatory and legal barriers, particularly surrounding airspace integration and safety standards, remain significant obstacles.

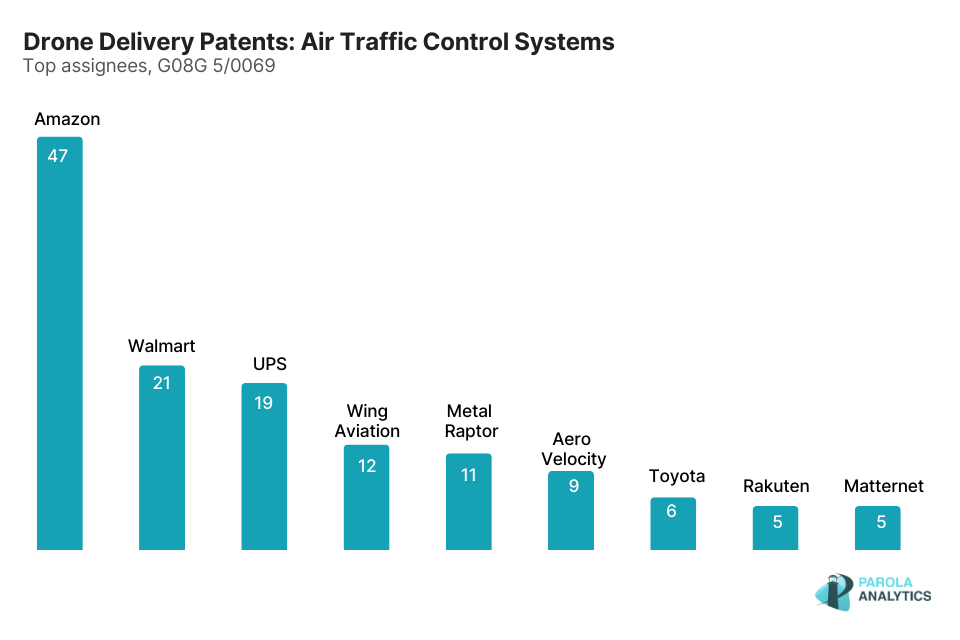

For example, a regulation prohibiting operators to fly their drone beyond visual line of sight (BVLOS) has a direct impact on innovations concerning UAS traffic management (UTM). UTM enables cooperative interaction between drone operators, service providers, and the FAA to manage airspace in real-time. Operators follow FAA constraints using automated systems via APIs, without relying on voice communications or direct air traffic control services. This indicates that drone operators must employ more advanced collision avoidance systems in the UAV, as well air traffic control systems.

While we see more “mature” companies in this space, we also see other innovators such as Metal Raptor and Aero Velocity.

While drone delivery services hold immense potential, key challenges must be addressed before they can achieve widespread adoption. Regulatory reforms, technological breakthroughs will be critical in overcoming current barriers.

To explore more insights into this evolving industry, download our Drone Delivery Patent Landscape Report. We provide a more in-depth analysis on patenting activity, key players, emerging startups, and notable IP shaping the future of drone delivery.