The growing mixed reality (MR) industry is now at a point where it is churning out new iterations of MR-related products and services more often. So, the question which MR system or platform to buy or adopt is one that many people are probably looking at more closely now.

Also, the number of companies developing MR-related hardware and applications will likely surpass, if it has not already done so, the number of companies developing smartphone-related hardware and software. This is to be expected: MR is being touted as the next big thing after smartphones. Importantly, MR covers a wider swath of potential applications than is possible with smartphones. Thus, MR offers any company the potential to corral a significant share of one or more of many budding MR markets and market segments.

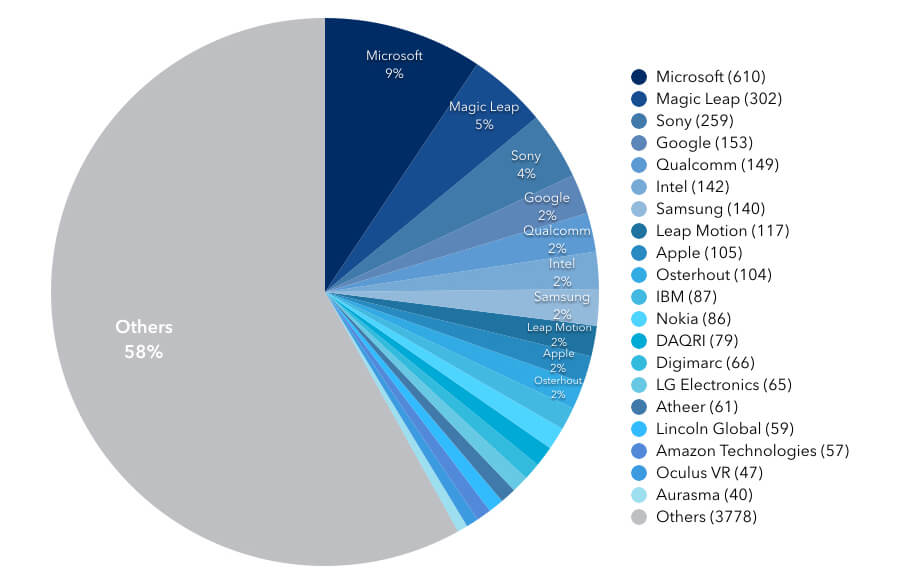

Based on our preliminary search and analysis, Microsoft has had more MR-related utility patents and patent applications (P/PA) with filing dates over 2002-2016 than any other company as shown on Fig. 1. Microsoft ranked either 1st or 2nd not only in Gaming, Collaborative Systems, Commerce, and Design, but also in Learning, Fitness, Social Network, and Entertainment.

Fig. 1. Companies with the most number of MR-related P/PA over the 2002-2016 period.

Magic Leap, with about 302 MR-related P/PA (based on a preliminary search), ranked a distant second. Compared to other companies in this group, Magic Leap was notable in that it only had about 10 patents over the 2002-2016 period. Those patents accounted for a meager 3.3% of its total number of P/PA. This was likely partly due to Magic Leap’s having been founded only in 2011. Magic Leap has relatively many patent applications (200) compared to those of other companies, being ranked second to Microsoft in terms of number of patent applications over 2002-2016.

Microsoft, Magic Leap, and Sony each has significantly more MR-related P/PA than any other company. But unlike Magic Leap, which has yet to commercially launch its first MR product, Microsoft and Sony have already introduced Hololens and PlayStation VR headset, among other MR-related products or applications, into the market some time ago.

Apple ranked behind its competitors Microsoft, Sony, Google, Qualcomm, Samsung, and Intel in terms of number of MR-related P/PA, whether over the 2002-2016 or 2011-2016 period. But although Apple ranked only 9th overall, it ranked among the top 5 companies in five categories in terms of number of P/PA. Also, it ranked 1st in Pose Estimation and 2nd in Data Processing.

Table 1. Top 5 companies in terms of number of P/PA over 2002-2016 and 2011-2016 periods.

| 2002-2016 | 2011-2016 | % of P/PA from 2011-2016 (relative to total P/PA over entire 2002-2016) |

|---|---|---|

| 1. Microsoft (610) | 1. Microsoft (384) | 63% |

| 2. Magic Leap (302) | 2. Magic Leap (300) | 99% |

| 3. Sony (259) | 3. Sony (174) | 67% |

| 4. Google (153) | 5. Google (126) | 82% |

| 5. Qualcomm (149) | 4. Intel (127) |

Out of Microsoft’s 610 P/PA from 2002-2016, 63% (384) were from 2011-2016. Thus, Microsoft’s patent filing activity has significantly picked up during the last 5 years or so. Sony’s patent filings showed a slightly higher gain, increasing by 67% (174 versus 259) when comparing the two periods. Google, on the other hand, showed a more robust 82% hike (126 versus 153). Magic Leap’s 99% jump in the number of P/PA it owned was mainly due to its having had only 2 P/PA over 2002-2010, which then increased to 302 by 2016.

Table 2. Number of times a company appeared among the top 5 companies with the highest number of P/PA for each category* (2002-2016).

[table “” not found /]

*See “Top Patent Categories Relating to Mixed Reality,” N. Quevada, K. Pabelina, and V. Violago, Nov 24, 2017, https://parolaanalytics.com/top-patent-categories-mixed-reality/.

As Table 2 shows, Microsoft ranked 1st in 12 categories, 2nd in three categories, and 3rd in five categories. Overall, it ranked among the top 5 companies in terms of number of P/PA in 25 MR categories. In contrast, Sony ranked among the top 5 companies in only 18 categories.

Samsung, Magic Leap, and Google racked up similar number of categories (either 12 or 10) in which they ranked among the top 5 companies with the most number of P/PA over 2002-2016.

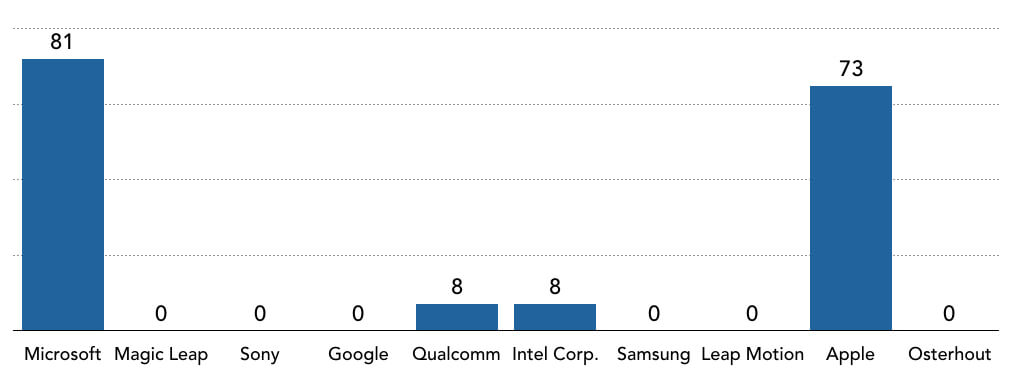

Fig. 2. Number of MR-related P/PA acquired by some of the top 10 companies over 2002-2016.

Fig. 2 shows that Microsoft and Apple were pretty much the only companies that made significant MR-related company or P/PA acquisitions from 2002 to 2016. Microsoft was reported to have paid close to $150 million for about 85 P/PA directed to AR and head-mounted devices from Osterhout Design Group. Microsoft and Apple thus appear aligned in terms of their strategy of securing MR expertise by acquiring MR-focused companies or MR-related IP assets that they like, rather than simply developing most of their MR-related patent portfolio in-house.

Disclaimer: Data used for the preparation of this article was based on a preliminary search only. Parola Analytics, Inc. does not make any representation regarding the accuracy or validity of the data, analyses, and conclusions presented in this article.