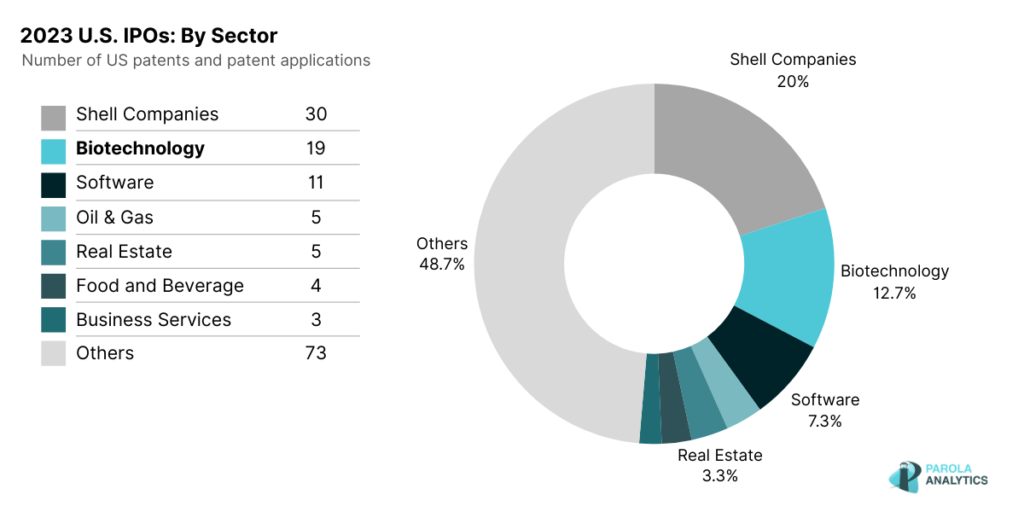

The U.S. stock market saw 155 initial public offerings (IPOs) in 2023. Excluding shell companies, the biotechnology sector emerges as the leading industry, with 19 companies going public as of December 27, 2023. However, this still illustrates a significant decline from 2021 — a record-breaking year for biotech company IPOs.

There were 19 biotech IPOs in the US in 2023, a steep decline from 2021

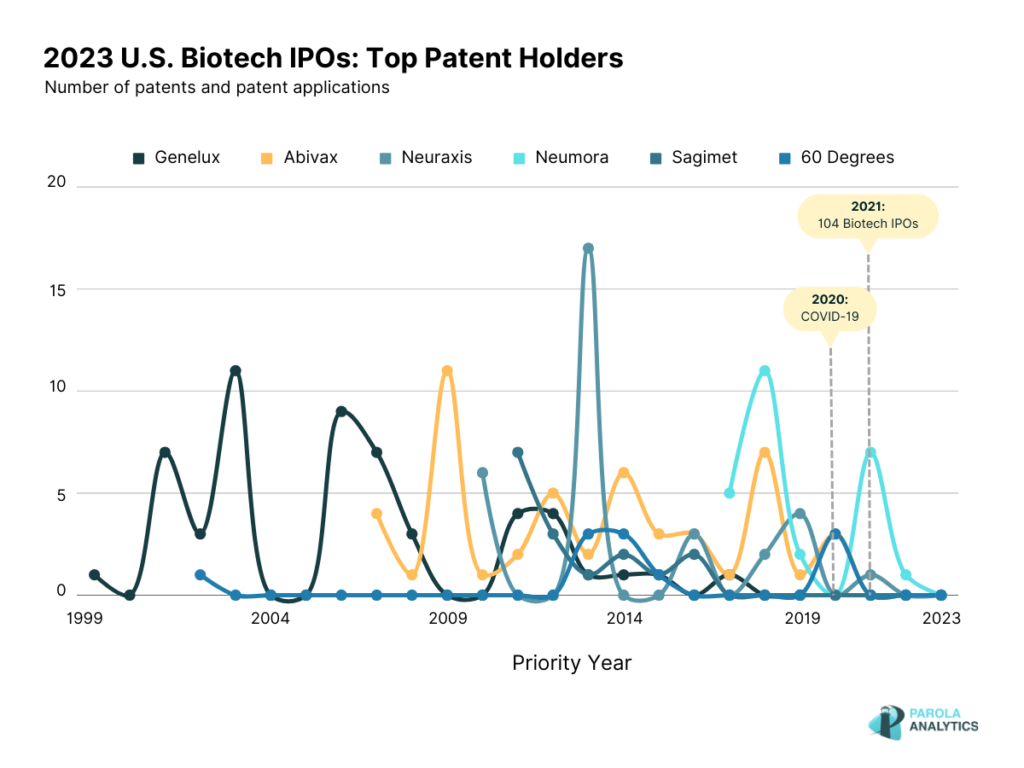

According to a BDO biotech brief, there was a surge in biotechnology IPOs in 2021, totaling 104, largely attributed to the pandemic and heightened interest in COVID-19-related vaccines and drugs. As investor interest grew in this sector, driven by the potential for significant returns from mRNA and other related technologies, pharmaceutical and biotechnology companies recognized the opportunity to tap into capital markets. This would allow companies to secure the necessary funding for sustaining their research and development.

In 2022, however, we saw a significant decline, with only 21 biotechnology IPOs, possibly influenced by economic uncertainties. Investors may have shifted focus to candidate drugs already that are already in clinical trials. This year, we see yet another decrease, with only 19 biotech companies launching IPOs in the U.S.

List of all 2023 Biotech IPOs in the U.S.

| Company | IPO Date | Market Capitalization |

|---|---|---|

| Cadrenal Therapeutics (CVKD) | January 20 | 8.60 M |

| Genelux (GNLX) | January 25 | 362.55 M |

| Structure Therapeutics (GPCR) | February 2 | 1.47 B |

| Mineralys Therapeutics (MLYS) | February 9 | 379.40 M |

| CytoMed Therapeutics (GDTC) | April 13 | 49.23 M |

| Acelyrin (SLRN) | May 4 | 709.60 M |

| Azitra (AZTR) | June 15 | 12.34 M |

| Intensity Therapeutics (INTS) | June 29 | 88.36 M |

| 60 Degree Pharmaceuticals (SXTP) | July 12 | 6.15M |

| Apogee Therapeutics (APGE) | July 13 | 1.64 B |

| Sagimet Biosciences (SGMT) | July 13 | 119.75 M |

| Turnstone Biologics (TSBX) | July 20 | 52.42M |

| NeurAxis (NRXS) | August 09 | 13.70 M |

| Neumora Therapeutics (NMRA) | September 14 | 2.38 B |

| RayzeBio (RYZB) | September 14 | 3.72 B |

| Adlai Nortye (ANL) | September 29 | 347.60 M |

| Abivax (ABVX) | October 20 | 689.11 M |

| Lexeo Therapeutics (LXEO) | November 2 | 366.38 M |

| Cargo Therapeutics (CRGX) | November 09 | 844.29 M |

US Biotech IPOs are expected to recover in 2024, analysts say

Despite facing challenges in recent years, analysts predict a resurgence in biotech stocks in 2024. This anticipated rebound is attributed to various factors, including advancements in critical areas like cancer and immunology. According to Roel van den Akker, Pharmaceutical and Life Sciences Deals Leader at PwC, there is “cautious optimism” surrounding the reopening of the IPO window for biotech companies characterized by a “distinctive scientific approach and robust clinical data”. The subdued nature of the IPO market in 2023 has left numerous companies well-positioned for potential listings in 2024.

Patenting activity of 2023 U.S. Biotech IPOs

In this article, we looked into the U.S. patents and patent applications (P/PAs) of selected 2023 IPOs, specifically on the biotechnology sector. Out of the 19, 12 biotech companies have U.S. patents and patent applications with Genelux as the top assignee followed by Abivax, NeurAxis, Neumora Therapeutics, Sagimet Biosciences, and 60 Degrees Pharmaceuticals.

A 2015 study relating patent demands and IPOs concluded that companies often face more patent-related issues like lawsuits and licensing demands around or soon after going public. This is particularly exploited by non-practicing entities looking to capitalize on the limited time and resources of new IPOs to extract settlement and licensing fees. Owning IP assets, therefore, could be a double-edged sword. While it enhances a company’s market value, capital raising activities potentially put a target on these companies’ backs. (See also our report on Patenting Activitity of 2023 US Unicorns).

Genelux

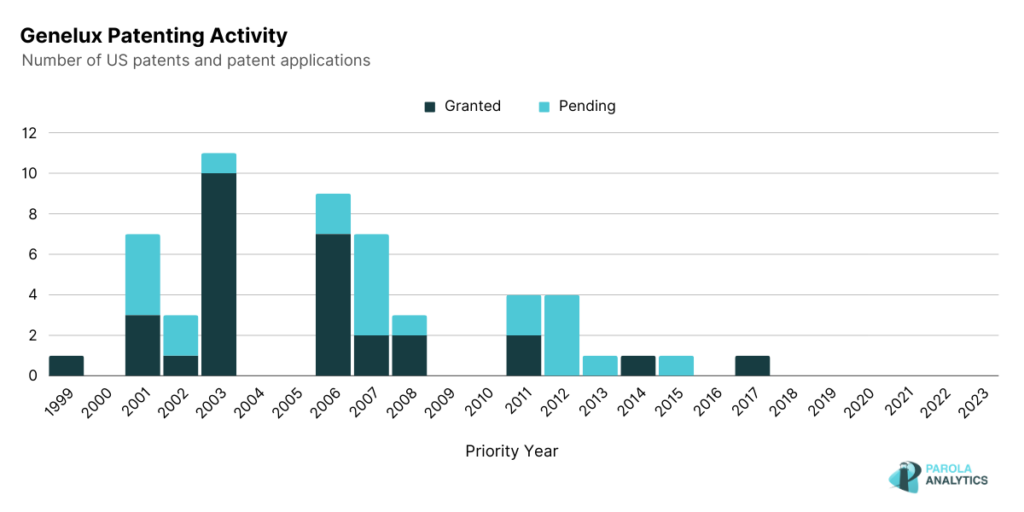

Genelux announced the pricing of their initial public offering on January 25, 2023. The shares, priced at $6, began trading on January 26. During the third quarter of 2023, the company announced two private placements and received $37.8 million of gross proceeds from the offerings. Genelux also received fast-track designation status from the U.S. Food and Drug Administration regarding the use of Olvi-Vec for the treatment of patients with platinum-resistant ovarian cancer. The fast track designation aims to expedite the review process of drugs aimed at treating serious conditions, ensuring that the product can easily enter the market.

Genelux focuses on developing “next-generation oncolytic viral immunotherapies” for patients with solid tumor types. Oncolytic immunotherapy is a type of therapy where modified viruses selectively replicate and kill tumor cells while leaving normal cells intact. Using this approach, Genelux developed Olvi-Vec, a modified vaccinia virus that directly kills cancer cells, triggers a tumor-specific immune response and changes the tumor microenvironment from a cool immunosuppressive state to a hot immunoreactive state Genelux’s use of a modified virus has been evident in some of their products and patents.

U.S. Patent No. 9,005,602 describes a method of preparing a modified virus and its application as a possible treatment for inflammatory diseases. In addition, U.S. Patent 9,492,534 also describes a method of preparing vaccines containing modified microorganisms and their use for the treatment of neoplastic and other types of diseases.

As observed, the patenting peaks are in the early 2000s, specifically in 2003 and 2006, and decreased in the latter years. In comparison with the number of pre-clinical publications of the company, they have over 100 publications with 79 published from 2010 to 2023.

Abivax

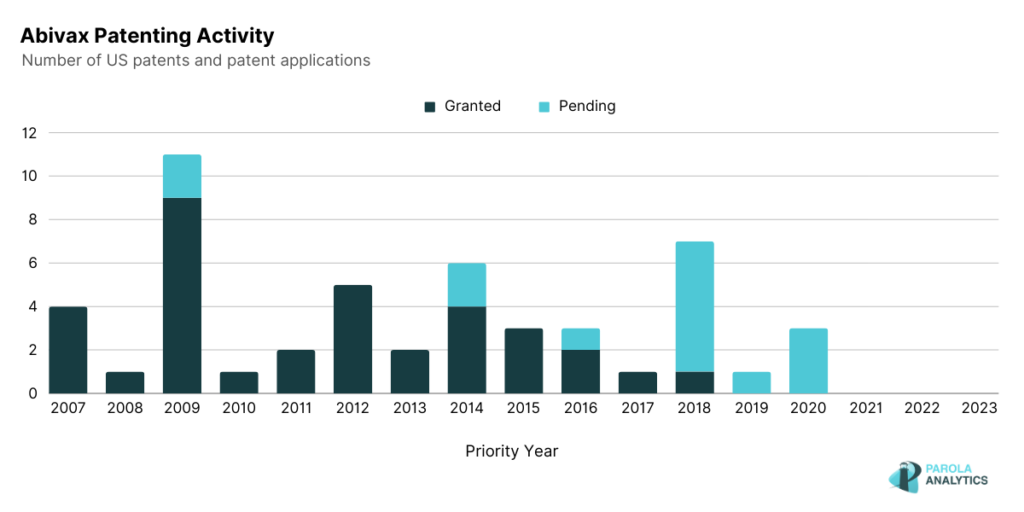

Abivax, a clinical-stage biotechnology company, focuses on the development of treatments that leverage the body’s inherent regulatory mechanisms to modulate the immune response in patients grappling with chronic inflammatory diseases. Notably, Abivax holds key patents and patent applications disclosing disease treatments, including compounds with potential applications in treating inflammatory diseases and the utilization of miRNA-124 as a biomarker. While Abivax’s 10-year patenting activity does not seem to have an obvious trend, the company is consistent in filing patents each year.

At the heart of Abivax’s groundbreaking endeavors is their lead drug candidate, Obefazimod, an oral, first-and-only small molecule armed with a novel mechanism of action. Obefazimod’s novel mechanism involves the enhanced expression of miR-124, a pivotal player in the regulation of the inflammatory response. In an Abivax patent, U.S. Patent No. 11,441,181, miRNA-124 as a biomarker is disclosed. This highlights the use of miRNA-124 being miR-124, a microRNA with significant regulatory functions, as a biomarker. The patent emphasizes its applicability in assessing viral infections and evaluating the efficacy of therapeutic treatments for such infections.

In line with the company’s mission of developing treatments for chronic inflammatory diseases is U.S. Patent No. 10,435,370 which discloses administering quinoline derivatives-based compounds to a patient. Some of the diseases which this invention aims to treat include inflammatory bowel disease, rheumatoid arthritis, and Crohn’s disease.

Neuraxis

Neuromodulation is defined as the alteration or modulation of nerve activities by delivering electrical stimulus or pharmaceutical agents specific to a target area. It has been used in treating chronic pain, deep brain stimulation, and nerve pain simulation for pelvic disorders.

Using its Percutaneous Electrical Nerve Field Simulation (PENFS) technology, NeurAxis develops neuromodulation therapies to address chronic conditions in children. NeurAxis also developed IB-Stim therapy to help in the reduction of abdominal pain associated with Irritable Bowel Syndrome. The IB-Stim works by sending gentle electrical impulses into cranial nerve bundles located in the ear. A similar technology is discussed in their patent, U.S. Patent No. 9,662,269. The ‘269 patent describes a device capable of stimulating points on the human ear using low voltage pulses delivered by needle electrodes implanted in the area.

In August 2023, NeurAxis announced their initial public offering of $6 per share and the gross proceeds were expected to be approximately $6.592 million. The company is also seeking additional approval from the U.S. Food and Drug Administration to treat patients with chronic nausea, post-concussion syndrome, chemotherapy induced nausea and vomiting, and cyclic vomiting syndrome.

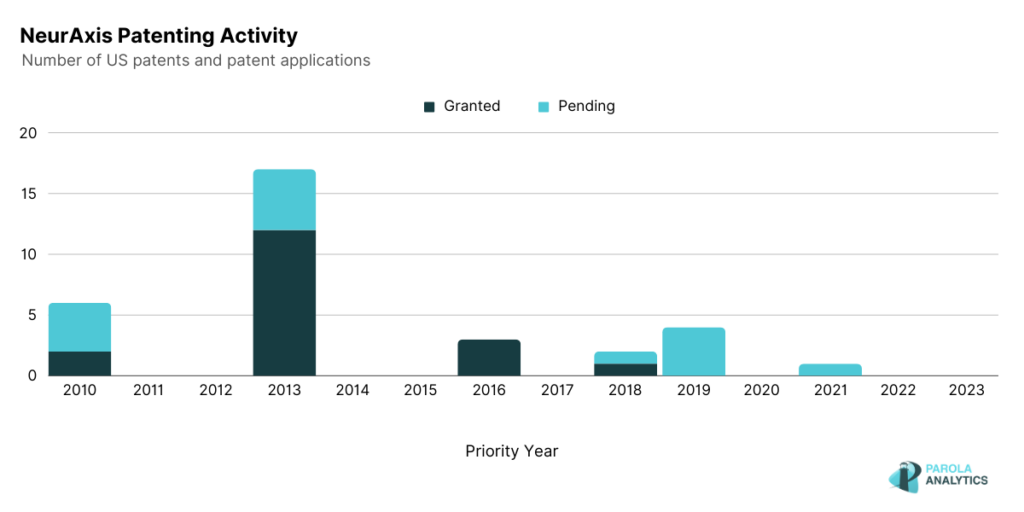

The patenting activity of NeurAxis shows a peak in 2013 where most of the patents are related to the auricular nerve field stimulation device.

Neumora Therapeutics

Neumora Therapeutics leads programs for neuropsychiatric disorders and neurodegenerative diseases. Their flagship program, navacaprant, a kappa opioid receptor (KOR) is currently in Phase 3 development as a potential treatment for major depressive disorder (MDD) and other neuropsychiatric disorders. Their patents, U.S. Patent No. 11,139,083 and U.S. Patent No. 11,244,762, describe methods of classifying and evaluating the mental health of patients. The ‘083 patent to be specific, uses machine learning to generate a trans-diagnostic classifier which includes a questionnaire in diagnosing different mental health disorders. Similar to the ‘083 patent, the ‘762 patent also uses mental health questionnaires and correlates the answers to an unprocessed MRI data to indicate the mental health of the patient.

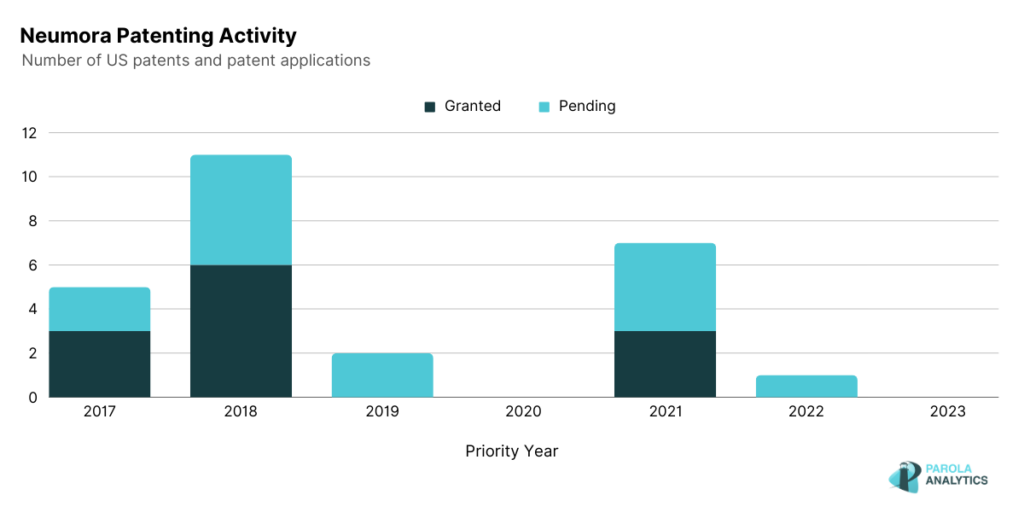

The patenting activity of Neumora Therapeutics is shown below. A notable peak is observed in 2021 where Neumora Therapeutics also announced its collaboration with Amgen, also a biopharmaceutical company. Under this collaboration, Neumora’s neuroscience platform was applied to the insights generated by Amgen’s deCODE genetics and human data research capabilities. This partnership could lead to the discovery of novel insights related to neuropsychiatric and neurodegenerative disorders, and eventually to the development of efficient treatments. In September 2023, Neumora announced their initial public offering price of $17 per unit with the expectation of raising gross proceeds around $250 million. Neumora was founded with the goal of addressing the global brain disease issue, and since then, it has raised over $850 million since its initial public offering.

Sagimet Biosciences

Sagimet Biosciences focuses on developing fatty acid synthase (FASN) inhibitors targeting metabolic pathways in diseases resulting from the overproduction of the fatty acid. FASN is a regulator of lipid synthesis and is implicated in diseases such as Nonalcoholic steatohepatitis (NASH) and other FASN-dependent tumor types.

Relating to their FASN inhibitors, Sagimet’s patents, such as U.S. Patent No. 8,871,790 and U.S. Patent No. 9,994,550, published on October 28, 2014 and June 12, 2018, respectively, focus on modulators of lipid synthesis and their use for the treatment of diseases characterized by dysregulation of the fatty acid synthesis. By offering new heterocyclic modulators of lipid synthesis with enhanced antiviral and anticancer properties, both patents address the limitations in current antiviral and anticancer therapies. In addition, U.S. Patent No. 10, 363,249, published on July 30, 2019, describes a FASN inhibitor which can be used to treat paclitaxel-resistant cancers. Paclitaxel is a chemotherapeutic agent commonly used as a treatment for various cancers.

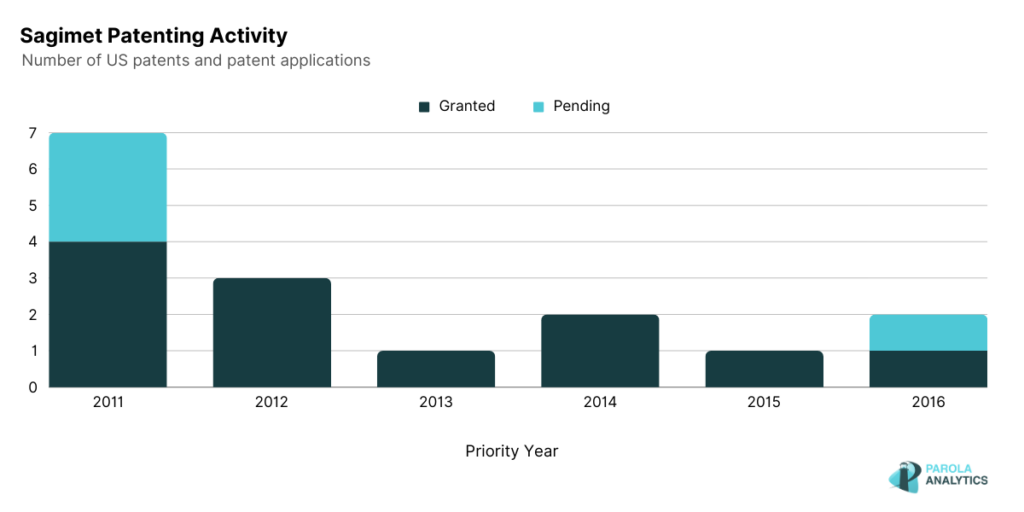

While there were no recent patenting activity from Sagiment since 2017, recently, in 2022, Sagimet announced that their product, Denifanstat, an oral FASN inhibitor showed positive results in its Phase 2b clinical trial among NASH patients. In July 2023, Sagimet announced its public offering price of $16.00 for its IPO of shares. This was Sagimet’s second attempt at going public, with their initial filing in April 2021 which was later withdrawn in March 2022. The decision to pursue a public offering for 2023 seems to align with the positive results of their clinical trial on their Denifanstat product, an oral pill for NASH.

60 Degrees Pharmaceuticals

60° Pharmaceuticals focuses on developing and producing medicines to treat and prevent infectious diseases. In 2018, their anti-malaria product, Arakoda (tafenoquine), was approved by the U.S. Food and Drug Administration, making prophylaxis for malaria simpler and more effective. The efficacy of their product has also been discussed in their granted patents.

Published on July 9, 2019, U.S. Patent No. 10,342,791 describes the use of different doses of tafenoquine to provide protection against symptomatic malaria among human subjects of different age and weights. On the other hand, U.S. Patent No. 10,517,854, published on December 31, 2019, describes the use of celgosivir and its different dosing regimens to treat the dengue virus. In 2023, 60° Pharmaceuticals was also granted a patent covering tafenoquine for treatment of COVID-19. Published on April 25, 2023, U.S. Patent No. 11,633,391 describes a method of administering tafenoquine to treat human lung infections and associated symptoms caused by gram-positive bacterium, fungus, and/or virus such as SARS-CoV-2. In July 2023, 60° Pharmaceuticals announced the closing of their initial public offering at a price of $5.30 per share, just 2 days after they began trading.

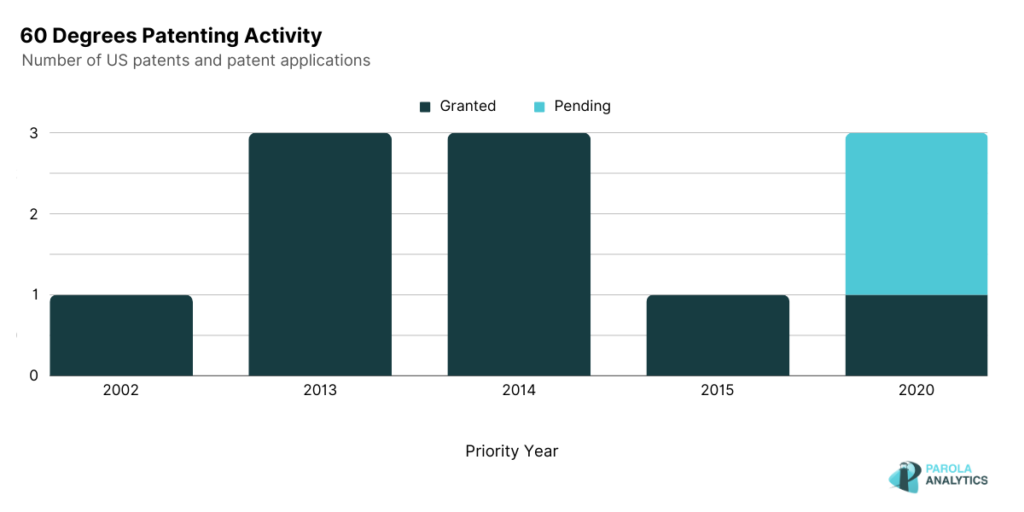

Coinciding with the patent peak activity in 2014, 60° Pharmaceuticals signed an agreement with Singapore General Hospital and Duke-NUS Graduate Medical School to study the efficacy of Celgosivir as treatment for dengue patients. Another notable peak in 2020 is observed which coincides with 60° Pharmaceuticals announcement that their initial testing of tafenoquine as a treatment for COVID-19 had shown good results.