A patent application from Mastercard says an artificial intelligence system can be trained to calculate optimum prices for goods in a store, and facilitate a dynamic pricing mechanism that works in real time.

Mastercard is accepted in at least 35.9 million locations, including online and physical stores, across 210 countries and territories. The Purchase, N.Y.-based financial services company has also been a proponent of low-cost Internet of Things (IoT) technologies that take advantage of real-time data streams. Its recently published USPTO filing appears to be another IoT implementation, aimed specifically at boosting physical stores’ sales.

Unlike their online counterparts, brick-and-mortar merchants cannot readily modify their shelf prices in response to changing market conditions. In fact, retailers spend over $100 billion a year manually changing price labels. Mastercard says static pricing mechanisms fail to efficiently adapt to changing supply and demand, leading to waste and lost revenues.

The patent application mentions how an electronics store, for example, might benefit from dynamic pricing. Besides boosting profits, the mechanism can help the business clear its existing stock before having to allocate display space for newer versions of gadgets or appliances.

Similarly, groceries would be able to cut down on food waste, as items nearing their expiration or best-use dates get a better chance at being sold when their prices lower. This advantage cannot be understated—groceries’ high volume, low margin business model generates an estimated 43 billion pounds of food waste annually.

Mastercard presents a system featuring data-driven AI and IoT electronic price displays as a superior alternative to legacy pricing approaches.

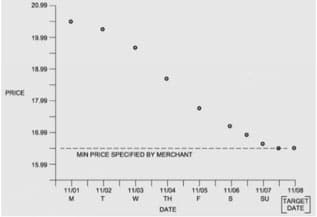

An example price-versus-date graph for a product, showing an optimum price curve and the merchant store’s minimum price.

Dynamic prices are determined by an AI trained on “enhanced data,” comprising primary information from a merchant’s database, along with secondary information from a third-party data source.

The primary information may cover several years of historical data, pertaining to:

- timestamps for when goods are stocked, sold, and targeted for sale;

- pricing data for stocked and purchased inventory;

- merchant details such as location, type of inventory, and competition; as well as

- geolocation information including supply and demand, inflation, depression, consumer habits, and competitors’ prices.

Meanwhile, the secondary information may include one or more years of historical third-party primary information for one or more other merchants or other purchase incentives.

An enhanced data engine uses the primary and secondary information to inform merchants of:

-

- periods within which to dynamically update the price of the product to maximize revenue;

- price changes over time

- a first optimal price for maximizing sales and a second optimal price for maximizing revenue;

- the average/total numbers of customers per period;

- the number of competitors within a particular distance from the store;

- the average/total revenues/losses per period; and

This enhanced information is then fed to an AI that sets the optimum price curve for a product. Merchants can access the data via a dashboard and rules interface, through which they may also specify the minimum price they are willing to sell an item.

Optimum prices are shown in real-time on electronic price displays, which may be mounted on store shelves, or be on a smartphone application displaying product prices. In one embodiment of the invention, the IoT pricing mechanism comes in the form of a pricing gun that prints labels with up-to-date prices. It may also be a cash register that applies discounted prices at check-out.

Additionally, feedback from stores implementing the dynamic pricing mechanism may be used to improve the system. Real-time analytics can also be employed to help the AI fine-tune its optimum price curve for a product.

The rise of online shopping and the internet in general has indelibly altered the retail landscape: brick-and-mortar establishments need to take advantage of data if they want to keep up with their web-based competitors that can be accessed anywhere at any time. Mastercard’s proposed technology may be one way to make physical shopping a smoother experience, and make brick-and-mortar shops smarter and more competitive.

The featured patent application, “System and Method for Determining Optimum Price Curve and Dynamically Updating Product Price”, was filed with the USPTO on February 6, 2020 and published thereafter on August 12, 2021. The listed applicant is Mastercard International Inc. The listed inventors are Hari Manivannan, Sunny Fung, Douglas Roche, Jose Qiu Chou, Kevin Soncuya, and Shilpa Herenjal.