In this article, we discuss the various advantages and disadvantages one should consider when deciding whether to acquire a third-party patent asset or embrace licensing as a path towards a company’s growth. Both options have their merits, but which one a company should pursue depends mainly on the company’s circumstances. This is one decision that demands very careful deliberations. Else, choosing the less-than-optimal option for the company could severely impact a company’s competitive strength.

BENEFITS OF ACQUIRING PATENTS

Acquiring Third-Party Patents can be Cheaper than Running an R&D

One notable advantage of acquiring third-party patent assets is that it provides an opportunity to access technologies developed using technical expertise unavailable in-house or that are difficult or too expensive to acquire and grow over time. Thus, purchasing patent assets can be particularly beneficial to small or mid-sized companies for which R&D expenditures pose a significant challenge regarding time and money.

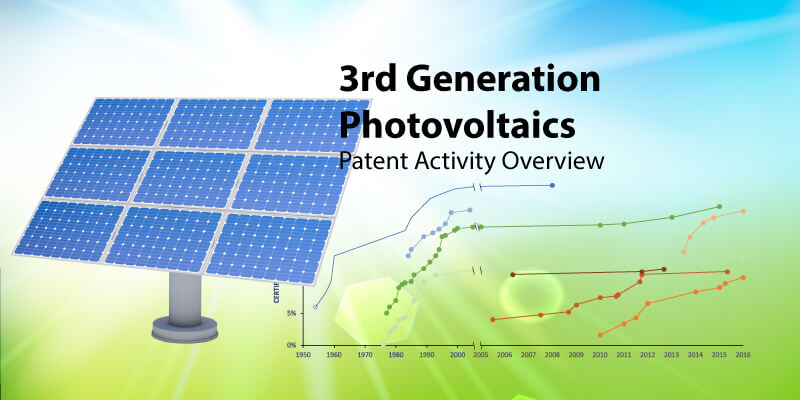

Studies have shown that the rate of innovation has been decreasing. Significantly, market trends indicate that the R&D needed to create those innovations, especially in maturing or mature technology areas or scientific fields, require increasingly greater resources over time. For example, advanced degrees are now becoming the norm for researchers tasked with creating innovation. Also, even assuming a company has a very productive R&D team, patent prosecution can take up to more than five years for each patent application. Further, companies have been moving away from basic and applied research and investing more in developmental research, with investments in the latter increasing by 325% over the 1980–2014 period while the former rose only by 244% over the same period.

Thus, purchasing third-party patents and patent applications can be a very useful way to build or beef up a company’s patent portfolio without having to deal with all the risks and expense that goes with creating technological innovations from scratch.

Acquired Patents can Confer Added Protection to the Company

Recently, non-practicing entities were reported to have increased their patent assertions against cloud providers and their customers. Over the period 2010–2017, cloud-based patent litigation was said to have climbed by 47% each year, while NPEs’ acquired more cloud-related patents at a pace that rose by 27%. One of the ways that Microsoft has dealt with this issue is to offer its Azure IP Advantage program to their clients, which allows them to access and use Microsoft’s portfolio of 10,000 patents for defensive purposes if patent litigation threatens their clients’ services that rely on Microsoft’s Azure cloud.

Acquired Patent Assets Can Enhance Competitive Edge and Bargaining Power

Another advantage to third-party patent acquisition is it can raise the company’s market value, as well as enhance its reputation and competitive strength. One study estimates that every additional patent granted before the acquisition increases the company’s total value by $144 million, while each additional patent application filed before the acquisition boosts the target company’s value by $81 million. Strong patents also keep their value for many years. Also, a positive correlation between patents and the company’s subsequent employment and sales’ expansion has also been observed.

Thus, it is quite likely that a company’s acquisition of third-party patent assets, mainly when they cover critical technologies, can similarly boost the company’s market value before, for example, a mergers and acquisitions deal.

Acquired Patents Can Serve as Additional Source of Revenue

Aside from giving a company greater freedom-to-operate, bargaining power, competitive advantage, and protection for its products and services, third-party patents can also generate additional revenues for the company via, for example, out-licensing. IBM, of course, is one of the most iconic serial licensers among technology companies. IBM is estimated to have garnered 88,000 patents over the years and is said to have collected about $20 billion or so of IP-related revenues. Over the 2008–2012 period, IBM’s patent portfolio reportedly generated from $1.1 to $1.2 billion annually. Although its licensing income has dropped each year since then to around $740 million in 2014, this still represents an amount greater than the total earnings of many companies.

Microsoft, on the other hand, was reported in 2013 to have generated $2 billion per year in revenue from Android patent royalties. Similarly, Qualcomm derives a substantial portion of its profit from licensing its 130,000 mobile technology-related patents to device makers, having received around $950 million from royalties for the June quarter of 2018.

BENEFITS OF LICENSING

Licensing Offers Time and Cost Savings

In many cases, licensing can be a win-win opportunity for both the licensor and licensee. For the licensee, sizable financial and time savings can come from not having to file patent applications. The licensor, on the other hand, gains licensing revenues from, for example, idle patents that may have nothing to do with the licensor’s current core businesses or priorities.

By licensing the patented inventions, the licensor also no longer need to spend large sums of money to commercialize products or services, break into new markets, maintain ownership of IP, and deal with other risks and downsides, such as loss of control over the patented invention or product quality issues.

The licensee, on the other hand, reaps the benefits of being able to introduce its own line of products and services into a market. The licensee can also cut down costs by not having to develop new technologies from the ground up and significantly reduce the time required to put out new products and services to the market. In the case of an exclusive license, the licensee gains a significant competitive advantage over rivals.

Licenses Afford Added Protection and Flexibility

Acquiring exclusive licenses can also prove to be more valuable than owning patents outright. For example, an exclusive license does away with patent-related expenses, as well as minimize exposure to third-party patent lawsuits.

An exclusive license also confers plenty of flexibility to the licensee. The licensee can agree to pay for a license for only a certain number of years, sell the licensed products and services at prices that allow it to profit after accounting for royalties, and the licensor can agree to grant the licensor the right of first refusal for future patents on improvements relating to the licensed technologies.

Licenses Permit Early Access to the Latest Technical Advances

Importantly, a license confers to small companies access to the latest technologies, which would otherwise be difficult if not impossible for them to acquire or develop on their own. Access to the latest technologies is essential for maintaining or enhancing a company’s competitive position, primarily if the company is already established in the market but is under threat from competing new products or novel production methods.

By acquiring a license, a company need not invest in laboratories, manpower, equipment, and a significant amount of time to develop a company’s version of the licensed technology. The company also avoids the specter of severe financial losses if it invested in developing its own technology and failed to produce something that could compete against existing technologies head-on.