Semiconductors are at the core of modern technology – they power our electronic devices, cars, communication networks, and more. In 2020, a global chip shortage strained various industries, struggling to meet consumer demand. Although the COVID-19 pandemic exacerbated this issue, it also highlighted the vulnerabilities that the supply chain inherently have.

Studies have revealed that 75% of manufacturing capacity and raw materials are located in East Asia and China. Around 92% of the most advanced manufacturing capacity is in Taiwan, 8 % in South Korea. Additionally, TSMC and Samsung control over 70% of global semiconductor manufacturing.

In 2022, the U.S. share for chip manufacturing was 10% globally. Europe’s share was 10% as well in 2020. To enhance local production and reduce reliance on other countries, both regions have enacted their own versions of the CHIPS Act.

In this article, we’re taking a closer look at the trends in the patenting activity within the US and EU semiconductor industry before and after the CHIPs Act.

U.S. CHIPS Act

The U.S. is proactively seeking to reinvigorate its global competitiveness through the Creating Helpful Incentives to Produce Semiconductor (CHIPS) and Science Act. Approved in August 2022, the CHIPS and Science Act provides a total budget of $280 billion to fortify domestic semiconductor production, fuel R&D innovation, and increase STEM workforce. Over 70 new fabs are already being built in Arizona and Texas alone, merely two years into the CHIPS Act.

Fig. 1. Top assignees in the US, by number of granted patents related to semiconductors from 2019-2024.

TSMC leading the U.S. semiconductor patent landscape

TSMC, still the world’s largest semiconductor foundry, leads the top U.S. assignees with more than 10,000 patents filed. Following with about 5,800 is South Korea’s Samsung Electronics, whose semiconductor products include memory devices, mobile processors and image sensors.

IBM, known for its their introduction of the industry’s first 7nm/5nm process technologies, follows with 2,432 granted patents. Its semiconductor research also boasts innovation in materials science, such as chemically-amplified photoresists, high-k gate dielectrics and nanosheet transistors. Completing the top five assignees are two industry leaders in memory chip production – Micron Technology, an American manufacturer with 11 global fabrication plants, and Kioxia, a spin-off from the Japanese electronics company Toshiba.

Fig. 2. Top US and EP Patent CPCs from 2019 to 2024.

The patents filings within the collected dataset mostly fall within the CPC subclass H01L that generally relates to semiconductor devices. More specific topics involve processes or apparatus relating to semiconductor manufacturing, semiconductor components within a common substrate and devices for rectifying, amplifying, oscillating or switching. Other top CPCs are H10B and G11C, which both relate to memory and storage technologies. This is expected given that key players in memory device manufacturing populate the top ten assignees.

Patent activity is expected to soar owing to the Semiconductor Technology Pilot Program, launched by the USPTO, a program aligned with the US CHIPS Act. This program offers a faster examination process for patent applications relating to boosting productivity of semiconductor device manufacturing processes, minimizing production expenses, or improving the supply chain.

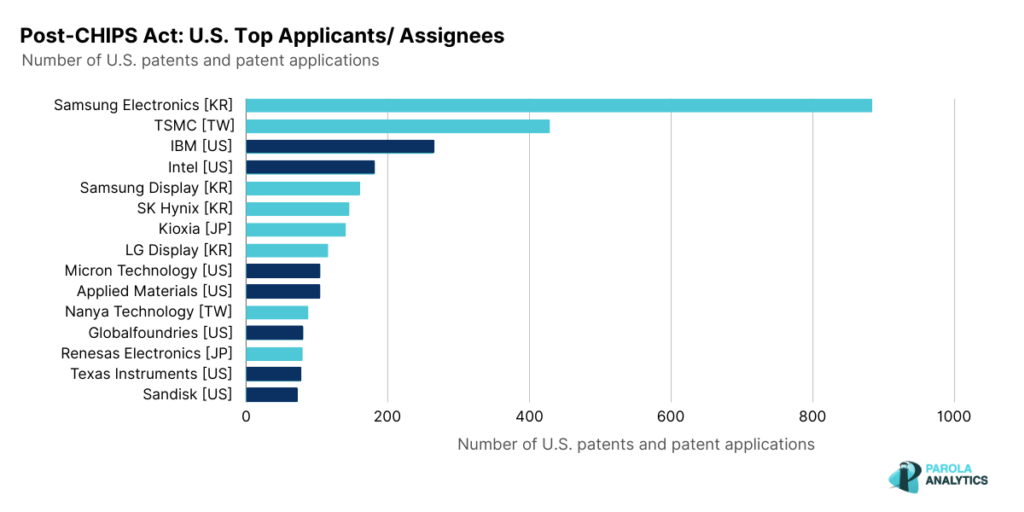

Since the signing of the CHIPS Act, there have already been 5,477 patents filed in the U.S.; 151 of which have already been granted. These filings are similarly led by Samsung Electronics, IBM and Intel.

Fig. 3. US Top Assignees that filed patents from August 2022 to present.

Intel the biggest recipient of CHIPS Act funding

Since the CHIPS Act was signed into law, there have been eight recipients of funding, with Intel getting the biggest share so far.

What’s up with EU?

Europe’s patent dynamics does not share the same intensity, with the number of granted patents by the EPO since 2019 being less than 15% that of the US filings. However, the European Union is also striving to boost its technological leadership in the semiconductor market, starting with the enforcement of the EU Chips Act in September 2023. This Chips Act sees a budget of up to €43 billion which will help strengthen research innovation with the aim to meet the projected market demand of 2030.

The EU CHIPS Act

The Chips Act also aims to address skills shortage within the industry. Additionally, these investments under this act will help achieve digital and green transition. While it is still too early to draw conclusions on its effect on EU patenting activity, general R&D is expected to grow following a number of planned and ongoing construction of new semiconductor fabrication plants in Europe. Among these are Intel, which is currently building two mega-fabs in Germany, as well as other facilities in France, Poland, Italy, Ireland and Spain.

Another example is the joint investment by TSMC, Robert Bosch GmbH, Infineon Technologies AG and NXP Semiconductors on the European Semiconductor Manufacturing Company (ESMC) GmbH, also in Germany. Both of these initiatives are supported under the framework of the EU Chips Act.

Fig. 4. Top assignees in the EU in terms of number of granted patents related to semiconductors from 2019 to present.

Looking at the recent five-year data on granted patents by the EPO, the French research institute CEA emerges as the top assignee, one of the pioneers for of the next generation fully depleted silicon-on-insulator (FD-SOI) technology. Mitsubishi Electric takes the third spot with 192 patents. Its European semiconductor business group focuses on the production of high frequency, optoelectronics, and power semiconductors. Samsung Electronics and Infineon Technologies also belonged in to the top 10 assignees.

The patents granted in the EU also largely fall under the similar CPC subclasses (See Fig. 3). However, included among the top CPCs is the topic of reduction of greenhouse gas emissions, as well as organic electric solid-state devices. The latter are commonly regarded as eco-friendly alternatives to typical semiconductor devices. It is interesting to see that the current technological innovations successfully reflect the EU Chips Act’s emphasis on green transition. An example of which are the sustainability efforts from the Belgian research institute IMEC, which ranks as 5th top assignee. It recently launched its Sustainable Semiconductor Technologies and Systems (SSTS) research program, which aims to inform industry partners of the ecological footprint of the IC value chain.