BOTS Inc., a Puerto Rico-based blockchain and robotics firm, stated in November 2020 that it is in discussions with “a major law firm” to enforce their newly-acquired Bitcoin ATM patent against Bitcoin ATM operators in order to collect royalty payments. The company expects revenues of $14 million to $18 million annually in connection to patent enforcement.

The planned litigation against US bitcoin ATM operators comes a few months after financial services company Square launched a consortium in September 2020 called the Crypto Open Patent Alliance which aims “to deter and defend patent aggressors” that may threaten the growth of cryptocurrency technology.

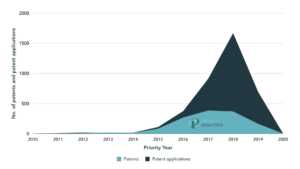

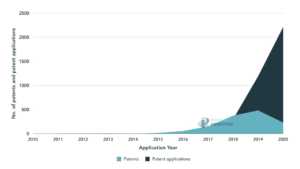

BOTS’ move indicates that further scrutiny into the cryptocurrency patent space may be necessary. According to data compiled and analyzed by Parola Analytics, blockchain-related patent applications more than doubled in 2017 and more than doubled again in 2018, hitting its five-year peak in the same year (See Fig. 1 and 2).

Given the delay between application filing and approval, some of these patents may have come into effect recently or may come into effect in the near future, suggesting that the risk for patent litigation concerning cryptocurrency may significantly rise in the coming years.

BOTS gained the rights to US Patent No. 9,135,787 or the “Bitcoin Kiosk / ATM Device and System Integrating Enrollment Protocol and Method of Using the Same”’ through the acquisition of its subsidiary First Bitcoin Capital in October 2020. The company described the patent as “related to the purchase and sale of cryptocurrencies utilizing a Bitcoin ATM or kiosk that allows customers to purchase Bitcoin or other cryptocurrencies by using cash, debit, or credit cards” which it claims are critical for the Bitcoin ATM networks to operate.

BOTS stated that all Bitcoin ATM manufacturing companies and Bitcoin ATM operators could be forced to use their patented technology. The company noted that it is reaching out to individual US-based bitcoin ATM operators to “reach an amicable arrangement without litigation”, adding that it will be “offering those operators to join a consortium of Bitcoin ATMs.”

First Bitcoin Capital acquired the patent in July 2019 and launched a reportedly unsuccessful campaign to secure up to $50 million in royalties by 2024, amidst the cryptocurrency community’s historical disapproval of patent aggressors that may restrict access to new technologies.

While the effects of BOTS’ plans to enforce its patent remains uncertain, the cryptocurrency industry’s patent space is one to watch as both big and small players have dipped their toes into blockchain patents. For instance, fintech Bloomio secured a blockchain patent for crypto-asset recovery in late October 2020 and payment network giants Mastercard and Visa have both been reported to be recently active in engaging in crypto-related patent activities.

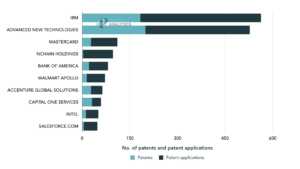

Moreover, as of 25 November 2020, Parola Analytics’ data indicate that the top 10 players for blockchain-related patents (See Fig.3) include companies such as IBM and Advanced New Technologies who both have over 500 patents each. In contrast, Mastercard who rounds up the top three players only has 111 patents. The current landscape of blockchain patents indicates a favorable playing field for early patent holders who may benefit greatly from enforcing their patents or licensing their patented technologies to companies who wish to participate in the emerging cryptocurrency market.

Note: Data from 2018 to present will still change due to the lag time between patent application and publication.